for the right price

Insights

Contact

Calculator

Get a first idea of your estimated mortgage loan in Germany

Who is Your German Mortgage?

Your German Mortgage is not only a mortgage broker - we are trusted advisors from MLP, Germany's leading independent financial consulting company based in Berlin. We have more than 25 years of experience in financing property, and we are the first consultants to offer an online mortgage service for expats in Germany.

How can you support me and my family?

Take advantage of our experience from 12,000+ consultations with international clients and of our knowledge of the mortgage and property market. Our financing services are streamlined for the demands of English-speaking buyers of property in Germany. Due to our network within MLP, we can assist you in asset management, real estate and insurance matters. And - most important - we make it happen.

Can I get a 100% loan with an EU blue-card?

At Your German Mortgage we don’t take NO for an answer. Behind the scenes, we have worked tirelessly to find a solution for mortgage finance for EU Blue Card holders. The choice of lenders is limited and will depend on their individual lending criteria, but we will match your circumstances with the best available finance options.

Why is your service free of charge?

Because like any mortgage broker in Germany, we are compensated by the lender you have chosen. Your German Mortgage is independent, we are committed to finding the best fitting solution for you - in other words, the most flexible mortgage and the lowest interest rates for your new home.

One hundred percent Complete data protection

German banks still don’t have many computerized processes, and so we deal with them in person. To get a quick, no-obligation assessment of your financing project from us, you do not need to enter all your personal data in our website form. Just send us an email with the data you want to share and you will get a result on the same day. We keep everything strictly confidential.

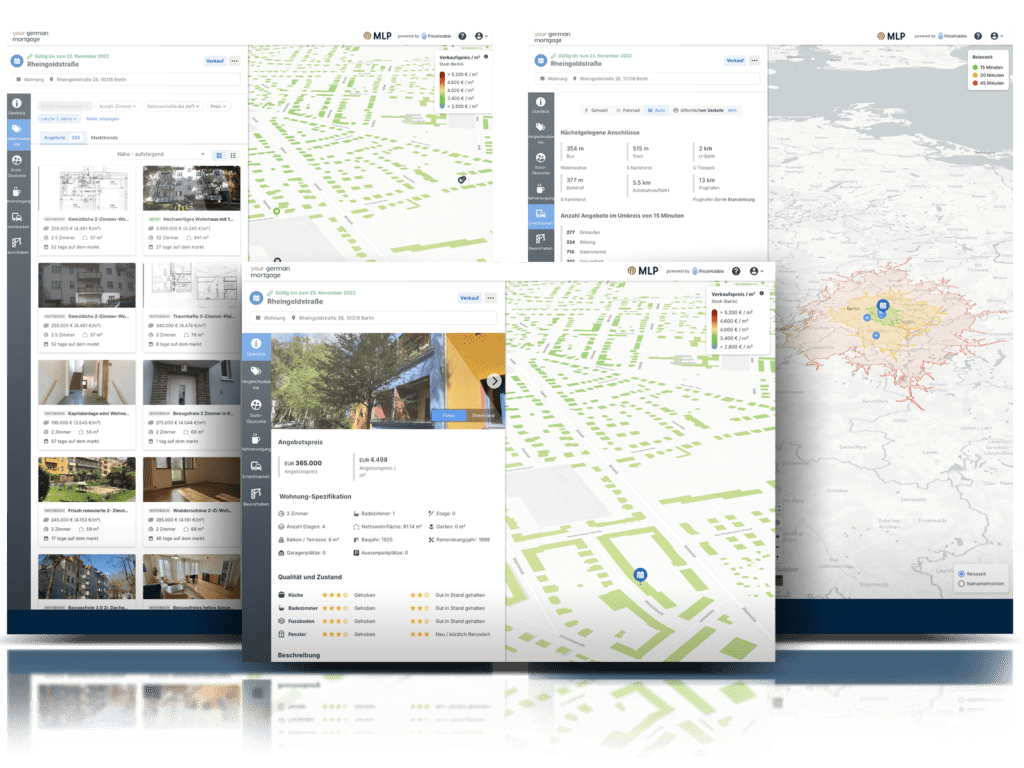

We help you verify the real price of your investment with a market and location analysis for free

For many years, real estate prices in Germany’s seven major metropolitan regions have known only one direction – up. This trend is amplified by the fact that safe deposits at banks no longer bring any return, yet deposit fees must still be paid.

Therefore, it is becoming increasingly important to have all the information about your investment at your fingertips. Because an owner-occupied property, your home, is also a financial investment.

In cooperation with PriceHubble, we help you verify the purchase price of the property you´re interested in, by providing you with a comprehensive market and location analysis.

More than 400 trusted partners

The real estate market in Germany has been growing for many years - and the trend is still upwards

The market in Germany has been growing since 2004, and there is no end in sight. This makes it a very competitive market for buyers. Speed is often the decisive factor.

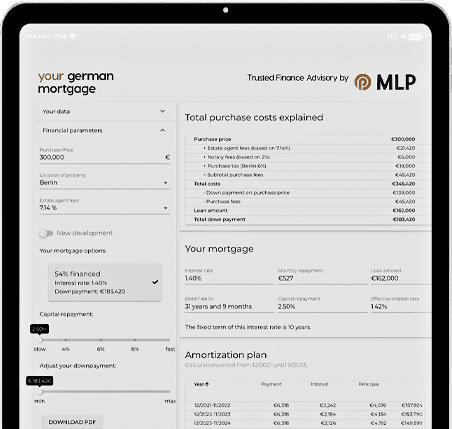

See your mortgage options with just a few clicks

While real estate financing in Germany is still very individual, our online calculator can give you an idea of your potential loan, conditions, payments, and much more. Rest assured: We are not looking to collect any personal data.

8000

HAPPY

clients

25

YEARS OF

experience

400+

Trusted

banks

100%

peace of mind

guarantee

Good news: EU Blue Card and 100% mortgage finance

We have been working for a long time to make mortgage finance options available for EU Blue Card holders.

A few banks offer loans with a down-payment of 20% of the purchase price plus purchase fees (tax, notary, real estate agent) paid with your own cash.

But we also work very closely with the very few banks that offer 100% financing (excl. purchase fees) for Blue Card holders.

What is more, we have access to the financing offers of a bank that exclusively finances our clients.

We will contact you via video call

Learn how to get the best financing for your property in Germany